A NEW trend is taking place in Bursa Malaysia. Delisting of a company can be effected by the stock exchange or voluntarily by the target.

The 7 Biggest Mergers And Acquisitions

InBev offered to buy.

. InBev and Anheuser-Busch. RM995 million Mandatory Takeover of DBE. Doh Properties Holdings Sdn Bhd.

RM686 million Mandatory Takeover of GSB Group Bhd. Advised MMC Corporation Berhad a multinational company listed on the Main Market of the Malaysian Stock Exchange on its RM93 Billion takeover of Malakoff Berhad a company listed. A Reverse Takeover RTO often known as a reverse IPO is the process in which a small private company goes public by acquiring a larger already publicly listed company.

Malaysias Biggest Investment Forum Investlah Community Free For All Takeover-ed companies in Malaysian history. New life is being injected into listless companies by new shareholders looking for a quick way to obtain a listing status to house their businesses. According to Forbes worlds biggest public companies list Altria Group is the 237th biggest public company in the world and has a 1014 billion market value as of May 2015.

In order to acquire the larger. Bursa Malaysia will automatically suspend trading in the targets shares when less than. Acquire an entire existing company.

EcoWorld-UEM Sunrise merger plans terminated The proposed merger between property developers UEM Sunrise Bhd and Eco World Development Bhd EcoWorld dissipated. Page 3 of 26 CHAPTER 1 KEY LAWS AND REGULATIONS Public mergers acquisitions in Malaysia Code Takeovers are primarily governed by the Capital Markets and Services Act. Heres a breakdown of the top 11 biggest takeovers in history in each of 10 different industries including technology airlines finance entertainment automotive medical.

Coming out to more then 57 billion dollars this represented one of the largest buyouts in tech history. An RTO involves a smaller quoted company taking over a larger unquoted company by a share-for-share exchange. In June 2008 Euro-Brazilian beverage company InBev made an unsolicited bid for iconic American beer brewer Anheuser-Busch.

In Malaysia a bidder together with its Persons Acting in Concert PACs trigger the obligation to make a mandatory takeover offer to acquire all the shares of the target company if. A takeover occurs when an acquiring company makes a bid in an effort to assume control of a target company often by purchasing a majority stake. 62 In the event of a public takeover bid.

That is until you look at Silverlake who in 2013 bought Dell for 244. A bidder who makes or proposes a takeover offer must immediately make an announcement of its firm intention via a press. Reverse takeovers an explanation.

The acquisition of public companies in Malaysia is generally subject to a specific process of biding. Merge with an existing company.

7 Types Of Mergers And Acquisitions With Examples

Futuristic Long Island City Futuristic City Futuristic Landscape Architecture Design

The 7 Biggest Mergers And Acquisitions

11 Key Handover Letter Format Separation Agreement Template Lettering Agreement

The 7 Biggest Mergers And Acquisitions

Types Of Due Diligence Financial Legal Hr And More Ansarada

The Rise In Mergers Acquisitions In Benefits Outsourcing Gep

.jpg)

Top 10 Reasons Why Mergers Acquisitions Fail

The 7 Biggest Mergers And Acquisitions

11 Key Handover Letter Format Separation Agreement Template Lettering Agreement

7 Types Of Mergers And Acquisitions With Examples

Chocolate Logo Chocolatier Logo Design Inspiration

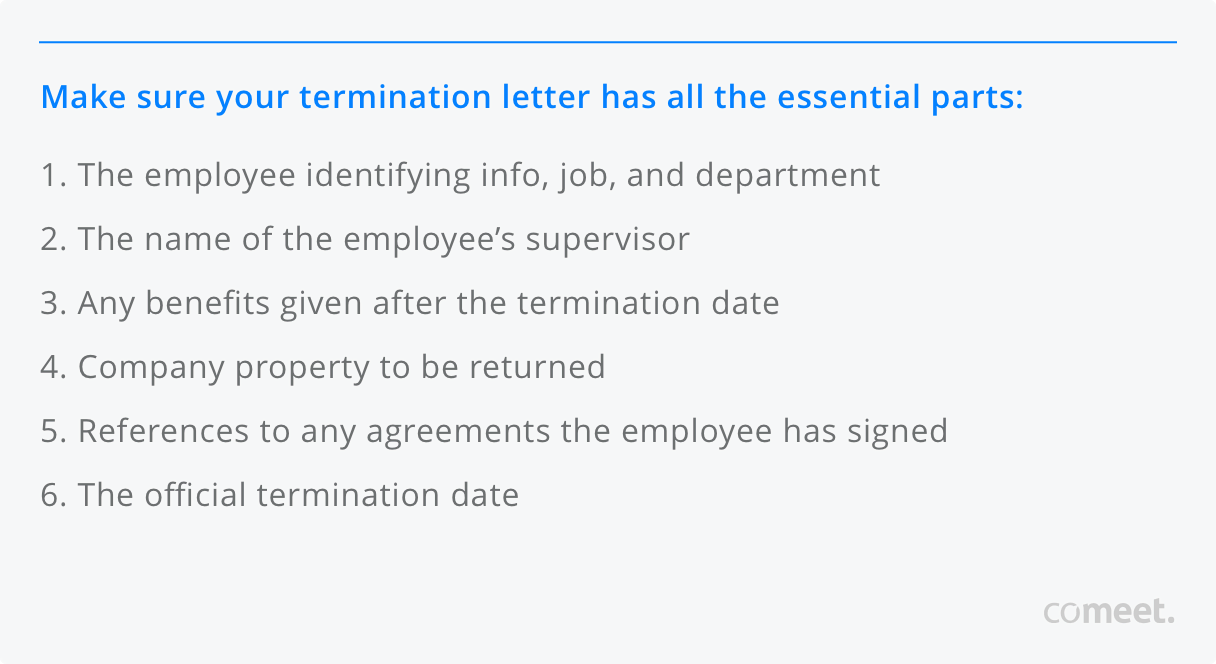

How To Write An Employment Termination Letter Covid 19 Templates Included Comeet

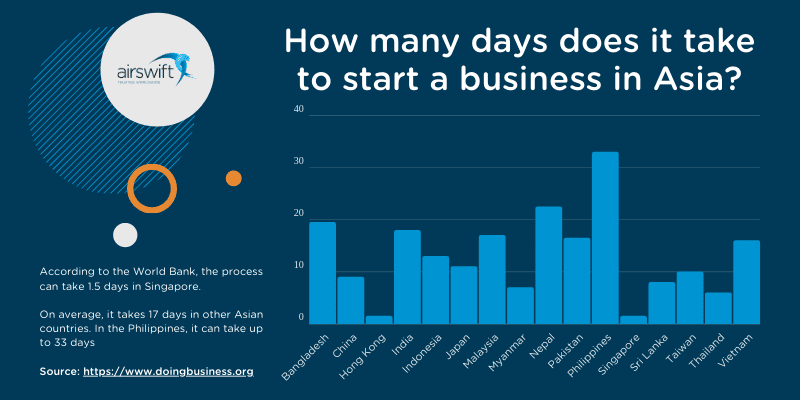

Navigating Global Expansion Strategy Using The Pestel Framework

:max_bytes(150000):strip_icc()/dotdash_Final_Currency_Appreciation_Definition_Apr_2020-01-063bf4cdbc9e4f4d82fa4aa46738498d.jpg)

Currency Appreciation Definition

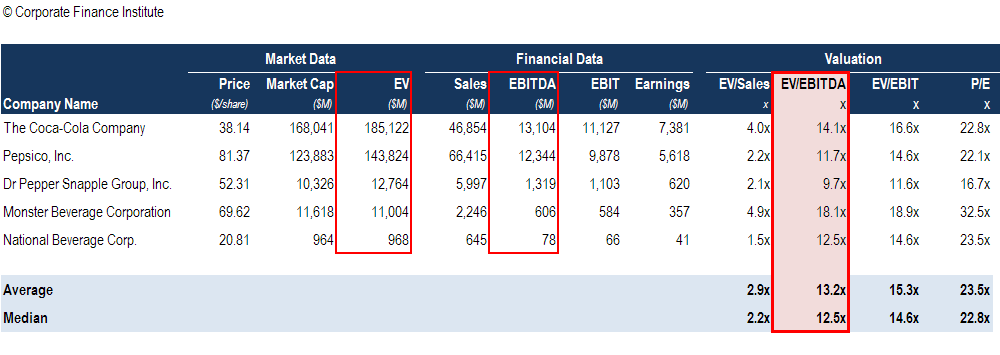

Ebitda Multiple Formula Calculator And Use In Valuation

7 Types Of Mergers And Acquisitions With Examples